Mbadi says state to review taxes on salaries to ease burden on workers

The CS said that taxes currently take up 8 per cent of employees' salaries, a burden that many find excessive.

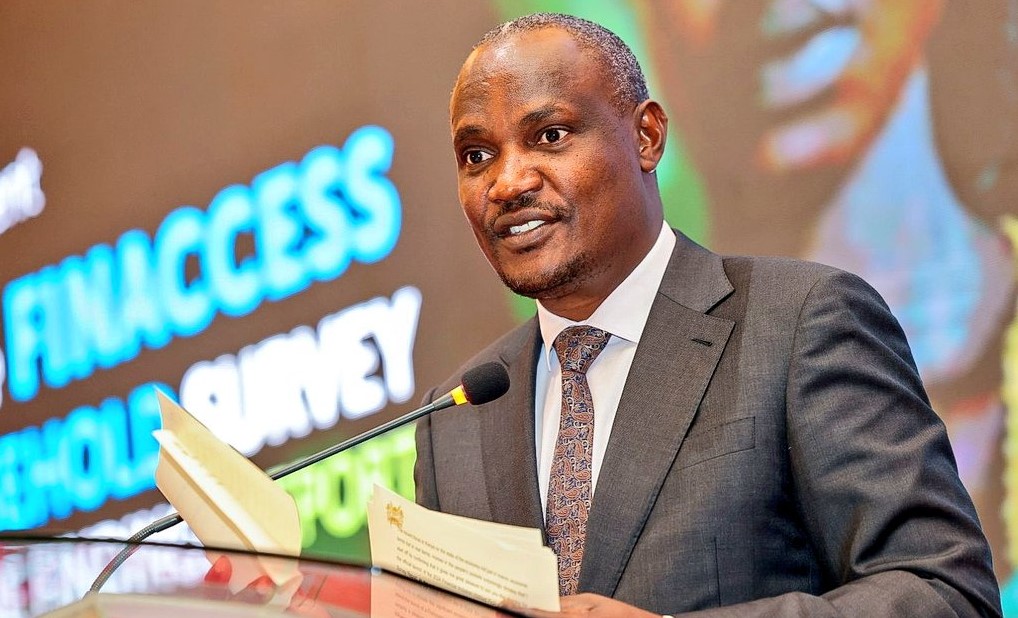

Treasury Cabinet Secretary John Mbadi has announced that the government is considering a review of the Pay-As-You-Earn (PAYE) tax to ease the financial burden on employees. This comes as his ministry acknowledges that high taxes on salaries remain a huge challenge for Kenyans.

"We have listened to the public. While inflation has eased to a 17-year low, the shilling has strengthened against major currencies, and indicators show that the economy is growing above Sub-Saharan Africa's average, people say they have no money," Mbadi said.

More To Read

- Motor vehicle sales soar as lending rates fall amid economic recovery

- KRA retains fringe benefit tax rate at 8 per cent for October–December 2025

- Why farmers are not taking up loans for scaling up- experts

- Construction sector seen as Kenya’s weakest job creator in 2025, CBK survey shows

- Auditor General flags CBK for hiring unqualified managers, ignoring HR Policies

- CBK under fire for withholding Sh3 billion in upfront agency fees, auditor-general says practice breaches law

The CS said that taxes currently take up 8 per cent of employees' salaries, a burden that many find excessive.

The CS was speaking during the launch of the 2024 FinAcess Survey by the Central Bank of Kenya (CBK), the Kenya Bankers Association (KBA), and FSD on Tuesday.

In addition to high taxes, Mbadi pointed out that high bank rates are another key factor hindering credit uptake, while the non-payment of pending bills further exacerbates financial challenges.

He urged financial institutions to lower lending rates to support businesses and the wider economy.

Budget deficit

The CS attributed the high taxes to a large budget deficit, which was initially over Sh900 billion, prompting the government to enhance domestic revenue mobilisation and reduce reliance on debt.

However, he noted that measures implemented have helped reduce the deficit to Sh780 billion, with expectations for it to fall below Sh760 billion in the next financial year.

"As it drops, benefits will be passed to employees," Mbadi said.

The Treasury CS also appealed to the CBK governor to continue discussions with banks to further reduce lending rates, which have been a barrier for small businesses.

"I thank the CBK governor for the continued talks with the banks. I have always told banks that an ease in lending rates or a hike affects them directly," he stated.

Despite the base-lending rate dropping to 12 per cent, Mbadi remains hopeful that a further reduction will occur following the CBK's Monetary Policy Committee meeting on December 5, 2024.

Last week, the bankers' lobby called for a reduction in the benchmark rate to stimulate economic growth and credit accessibility.

Top Stories Today